With enthusiasm, let’s navigate through the intriguing topic related to Sustainable Investing: A Green Tide Sweeping Global Capital Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

Sustainable Investing: A Green Tide Sweeping Global Capital Markets

Sustainable Investing: A Green Tide Sweeping Global Capital Markets

The world is waking up to the urgent need for sustainable practices, and this awareness is rippling through global capital markets. Investors, both individual and institutional, are increasingly prioritizing ethical and environmentally conscious investments, leading to a surge in assets under management (AUM) in sustainable funds. This shift signifies a tectonic change in the way we approach wealth creation, with profound implications for companies and financial markets.

A Green Rush: Assets in Sustainable Funds Soar

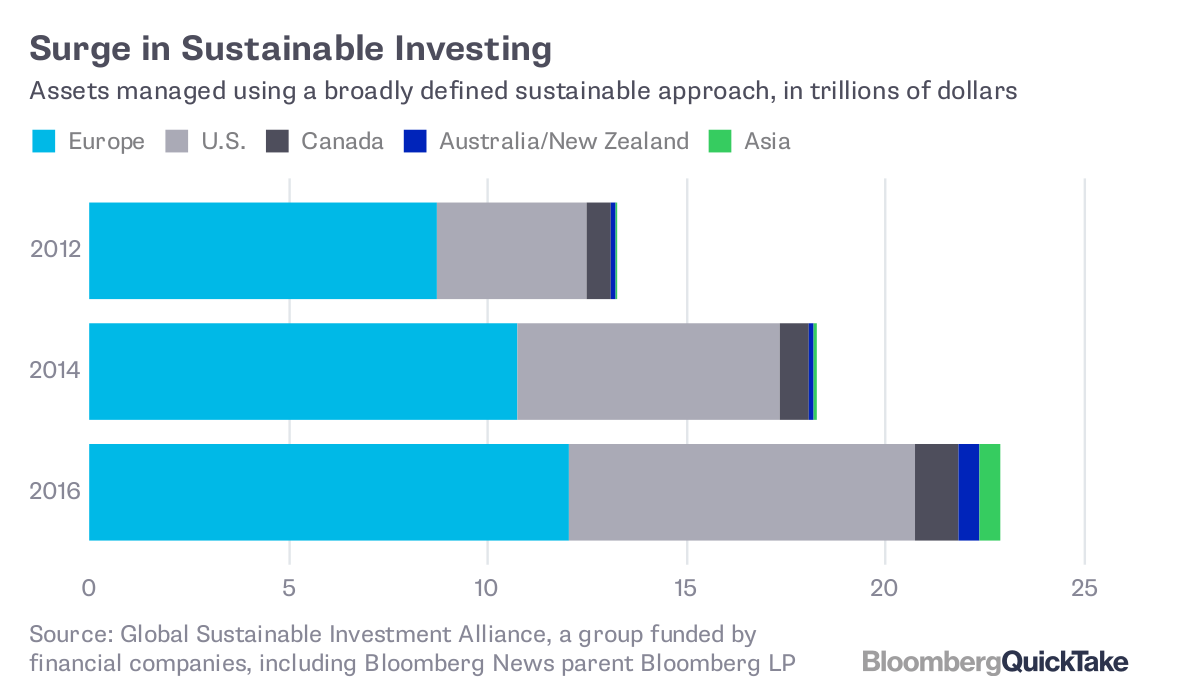

The growth of sustainable investing is undeniable. Global sustainable investment assets reached a staggering $45.5 trillion at the end of 2022, according to the Global Sustainable Investment Alliance (GSIA). This represents a 14.6% increase from the previous year, highlighting the accelerating momentum of this trend.

The United States leads the pack, with sustainable investment assets reaching $26.5 trillion in 2022. Europe follows closely, with $17.7 trillion in sustainable investments. Asia-Pacific, while still catching up, is experiencing rapid growth, with assets under management reaching $1.3 trillion.

This surge in assets is not limited to specific asset classes. Sustainable investing is permeating across all sectors, from equities and bonds to real estate and private equity. This broad adoption demonstrates the increasing mainstream acceptance of sustainable investment as a viable and even preferred strategy.

Driving Forces: A Multifaceted Push for Change

The rise of sustainable investing is fueled by a confluence of factors, both internal and external to the financial markets:

- Growing Environmental Concerns: Climate change, pollution, and resource depletion are becoming increasingly evident, pushing individuals and institutions to align their investments with their values and contribute to a more sustainable future.

- Regulatory Momentum: Governments worldwide are enacting policies and regulations that incentivize sustainable practices and hold companies accountable for their environmental and social impact. For instance, the European Union’s Sustainable Finance Disclosure Regulation (SFDR) mandates transparency in sustainability reporting for financial institutions.

- Investor Demand: A growing number of investors, particularly millennials and Gen Z, are prioritizing ethical and sustainable investments. They are seeking investments that align with their personal values and contribute to a positive social and environmental impact.

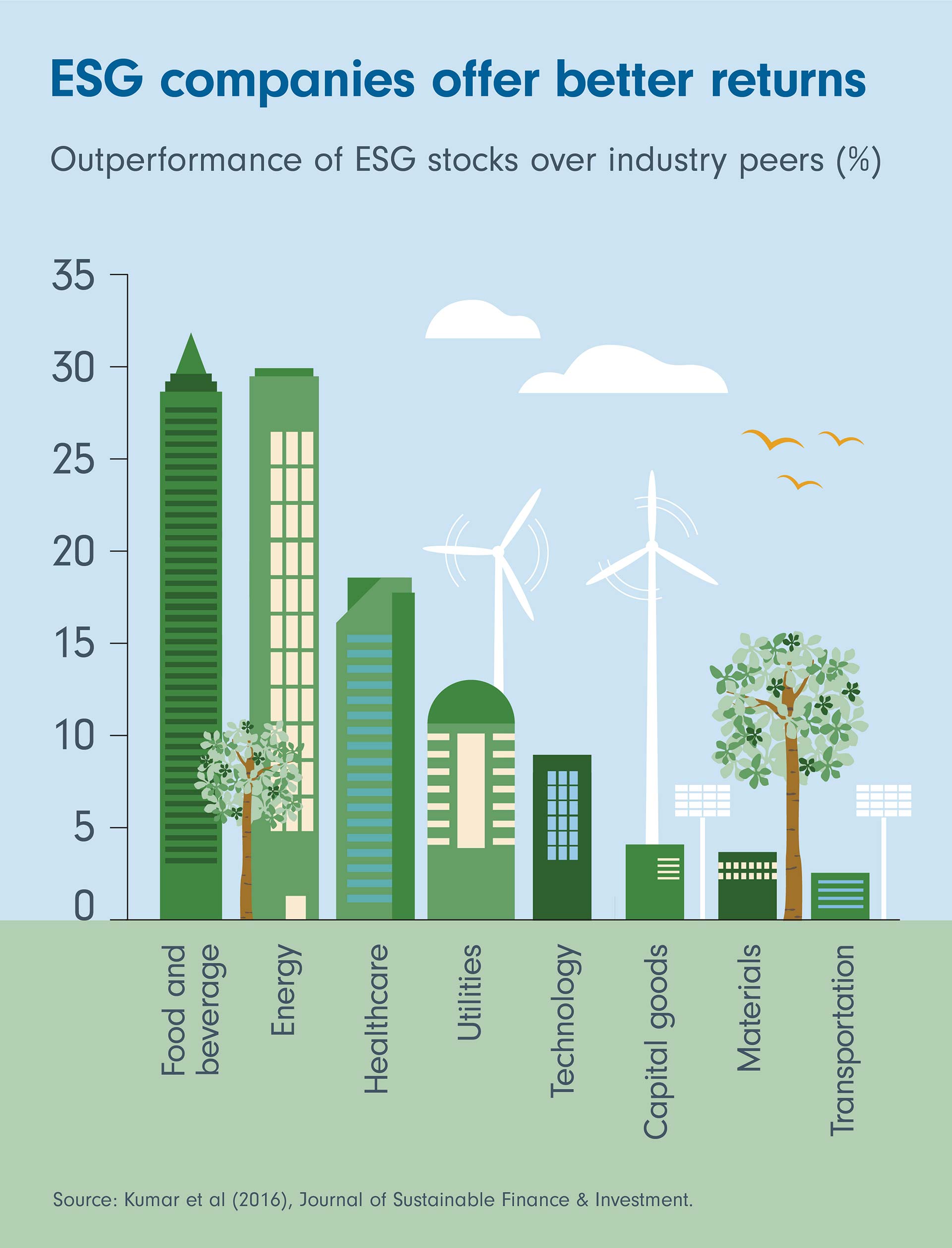

- Financial Performance: Increasing evidence suggests that sustainable investments can deliver competitive financial returns. Studies have shown that companies with strong ESG (Environmental, Social, and Governance) practices tend to outperform their peers in the long run.

- Technological Advancements: Emerging technologies like blockchain and artificial intelligence are facilitating the development of innovative sustainable investment solutions, making it easier for investors to track and manage their portfolios.

Impact on Companies: A Call to Action

The shift towards sustainable investing creates a significant opportunity and challenge for companies across industries. Companies with strong ESG practices are increasingly favored by investors, leading to:

- Improved Access to Capital: Sustainable companies are more likely to attract investors, securing funding for growth and innovation.

- Enhanced Reputation and Brand Value: A strong ESG profile enhances a company’s reputation and brand value, attracting customers and talent.

- Reduced Risk and Increased Resilience: Sustainable practices can mitigate environmental and social risks, leading to greater business resilience and long-term stability.

However, companies lagging in sustainability efforts face growing pressure:

- Increased Scrutiny and Regulatory Risk: Non-sustainable companies are increasingly subject to scrutiny from investors, regulators, and the public, potentially leading to reputational damage and legal liabilities.

- Limited Access to Capital: Investors are increasingly hesitant to invest in companies with poor ESG performance, potentially limiting their access to capital.

- Competitive Disadvantage: Companies with weak ESG practices may struggle to attract and retain talent, compete for customers, and adapt to evolving market demands.

Transforming Financial Markets: A New Era of Investment

The rise of sustainable investing is reshaping the landscape of financial markets:

Related Articles: Sustainable Investing: A Green Tide Sweeping Global Capital Markets

Thus, we hope this article has provided valuable insights into Sustainable Investing: A Green Tide Sweeping Global Capital Markets.

- Evolving Investment Strategies: Traditional investment strategies are being adapted to incorporate ESG factors, leading to the emergence of new investment products and services.

- Increased Transparency and Disclosure: Investors are demanding greater transparency and disclosure regarding companies’ ESG performance, driving a shift towards standardized and robust reporting frameworks.

- New Market Opportunities: Sustainable investing is creating new market opportunities for companies developing innovative solutions in sectors like renewable energy, green technology, and sustainable agriculture.

- Enhanced Risk Management: By integrating ESG factors into investment decisions, financial institutions can better manage environmental and social risks, leading to more robust and sustainable portfolios.

Challenges and Opportunities: Shaping the Future of Finance

Despite its undeniable growth, sustainable investing faces several challenges:

- Data Availability and Quality: A lack of standardized data and consistent reporting across companies makes it difficult for investors to accurately assess ESG performance.

- Greenwashing: Some companies engage in greenwashing, exaggerating their sustainability efforts to attract investors.

- Integration into Investment Practices: Mainstream financial institutions need to fully integrate ESG factors into their investment processes and decision-making.

However, these challenges also present opportunities:

- Developing Robust Data and Reporting Standards: Standardization of ESG data and reporting frameworks is crucial for fostering transparency and investor confidence.

- Combating Greenwashing: Increased scrutiny and regulatory measures are needed to prevent greenwashing and ensure the integrity of sustainable investments.

- Promoting Education and Awareness: Educating investors about the benefits and importance of sustainable investing is essential for driving further adoption.

Conclusion: A Sustainable Future Through Collective Action

The surge in sustainable investing is a powerful testament to the growing awareness of environmental and social issues. It represents a paradigm shift in the way we approach wealth creation, prioritizing long-term value and positive impact. While challenges remain, the momentum behind sustainable investing is undeniable. By working collaboratively, investors, companies, and policymakers can harness this trend to create a more sustainable and equitable future for all.

This movement calls for a collective effort. Investors must demand transparency and accountability from companies. Companies must prioritize sustainable practices and invest in innovation. And policymakers must create an enabling environment that supports the growth of sustainable investments. By working together, we can ensure that the green tide sweeping global capital markets translates into a more sustainable future for our planet and its people.

We appreciate your attention to our article. See you in our next article!

Apoteksangiran.my.id News Bisnis Technology Tutorial

Apoteksangiran.my.id News Bisnis Technology Tutorial