In this auspicious occasion, we are delighted to delve into the intriguing topic related to Sustainable Investing: A Green Tide Sweeping Global Capital Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

Sustainable Investing: A Green Tide Sweeping Global Capital Markets

Sustainable Investing: A Green Tide Sweeping Global Capital Markets

The world is changing. Climate change, social inequality, and environmental degradation are no longer distant threats, but present realities demanding immediate action. This shift in global consciousness has seeped into the financial world, where investors are increasingly demanding their portfolios reflect their values. The result? A surge in interest in sustainable investing, a trend that’s reshaping global capital markets.

A Green Rush: Assets in Sustainable Funds Soar

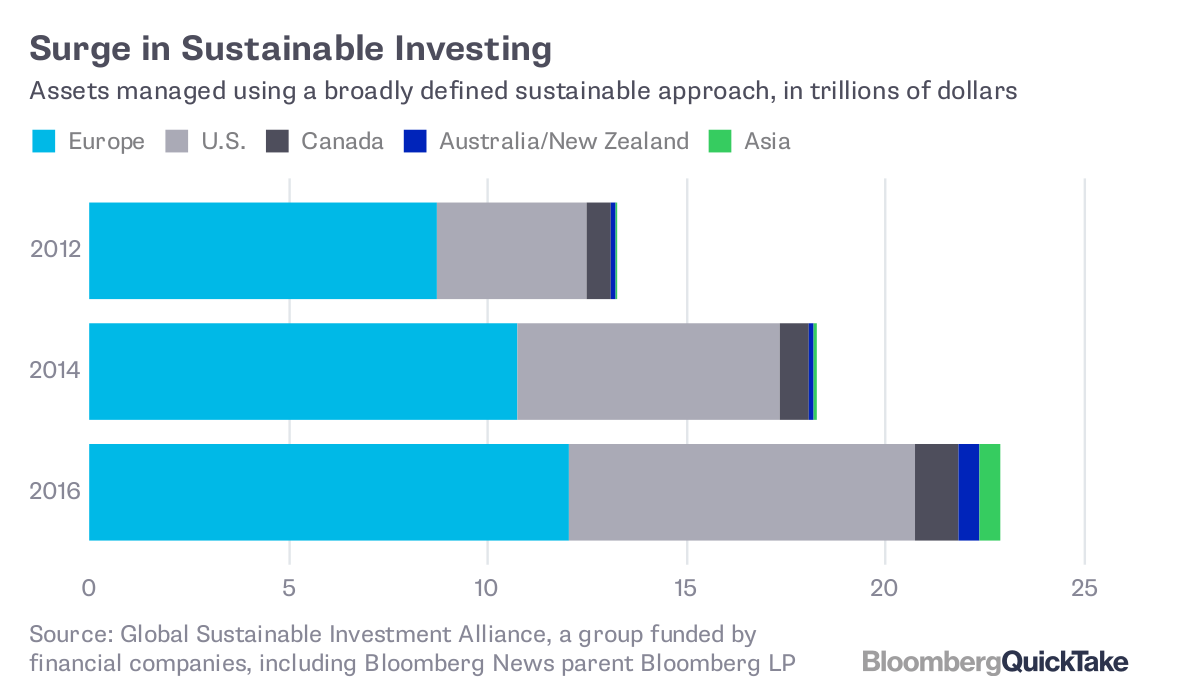

The numbers speak for themselves. Global sustainable investment assets have skyrocketed, reaching $35.3 trillion in 2020, according to the Global Sustainable Investment Alliance (GSIA). This represents a staggering 34% increase from 2018, and the trend shows no signs of slowing down.

Why the Shift? Factors Fueling Sustainable Investment Growth

This surge in sustainable investment is driven by a confluence of factors:

- Growing Awareness of Environmental and Social Issues: The public is increasingly aware of the urgency of climate change, biodiversity loss, and social inequalities. This awareness translates into a desire to invest in companies actively addressing these issues.

- Regulatory Pressure: Governments worldwide are enacting policies and regulations promoting sustainable investing. The European Union’s Sustainable Finance Disclosure Regulation (SFDR), for example, requires financial institutions to disclose their sustainability practices and the sustainability risks they face.

- Investor Demand: Millennials and Gen Z, who are increasingly concerned about social and environmental issues, are driving demand for sustainable investment options. They are looking for investments that align with their values and contribute to a more sustainable future.

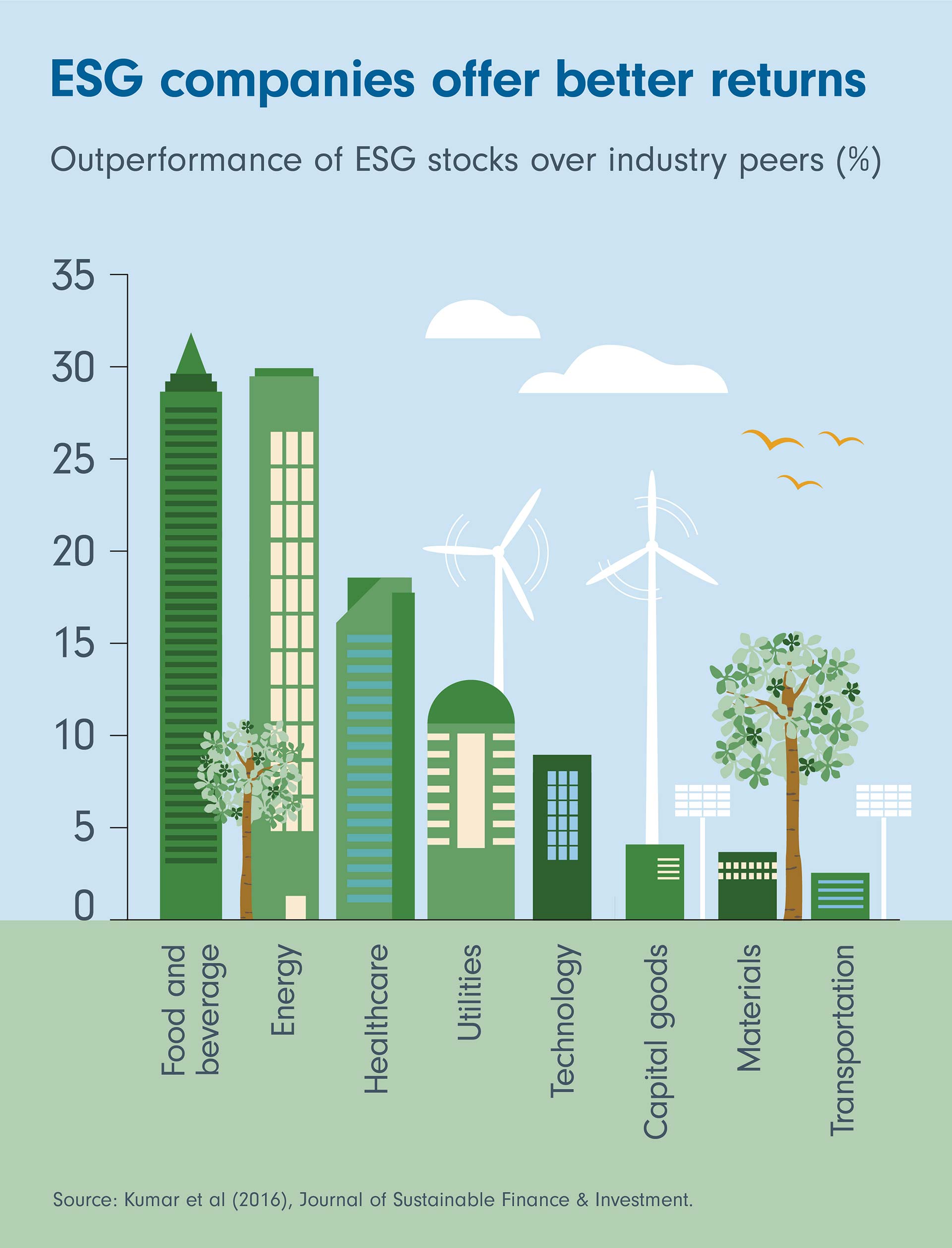

- Financial Performance: Studies have shown that sustainable investments can deliver strong financial returns. Companies with strong ESG (Environmental, Social, and Governance) practices often outperform their peers, attracting investors seeking both financial and ethical returns.

- Technological Advancements: Technological advancements, like blockchain and artificial intelligence, are facilitating the development of new sustainable investment products and services, making it easier for investors to access and track their investments.

Impact on Companies: A New Era of Transparency and Accountability

The growing interest in sustainable investing has created a new landscape for companies. It’s no longer enough to simply focus on profits; companies must also demonstrate their commitment to sustainability. This means:

- Enhanced Transparency: Companies are under increasing pressure to disclose their environmental and social impact. This includes reporting on emissions, waste management, human rights practices, and diversity and inclusion initiatives.

- Stronger ESG Practices: Investors are demanding that companies adopt robust ESG practices. This includes reducing their environmental footprint, promoting ethical labor practices, and implementing strong corporate governance.

- Focus on Long-Term Value Creation: Sustainable investing emphasizes long-term value creation over short-term profits. Companies are being incentivized to invest in innovation, research and development, and sustainable business models that create long-term value for stakeholders.

Impact on Financial Markets: A Paradigm Shift

The rise of sustainable investing is transforming financial markets in profound ways:

- Growth of Sustainable Investment Products: The demand for sustainable investment products has led to a proliferation of new funds, ETFs, and other investment vehicles focused on ESG criteria.

- Increased Competition: Traditional financial institutions are facing increasing competition from dedicated sustainable investment firms. This competition is driving innovation and pushing the industry to develop new products and services.

- Shifting Investor Preferences: Investors are increasingly prioritizing ESG factors in their investment decisions. This shift is influencing the valuation of companies and the allocation of capital.

Challenges and Opportunities

Despite the remarkable growth of sustainable investing, challenges remain:

- Greenwashing: Some companies may engage in "greenwashing," exaggerating their sustainability efforts to attract investors. This poses a risk for investors seeking genuine sustainable investments.

- Data Availability and Standardization: The lack of standardized data and metrics for measuring ESG performance can make it difficult for investors to compare companies and make informed decisions.

- Integration of ESG into Investment Processes: Many traditional financial institutions are still struggling to integrate ESG considerations into their investment processes.

Related Articles: Sustainable Investing: A Green Tide Sweeping Global Capital Markets

Thus, we hope this article has provided valuable insights into Sustainable Investing: A Green Tide Sweeping Global Capital Markets.

However, these challenges also present opportunities:

- Development of Robust ESG Standards: The industry is working towards developing robust ESG standards and metrics to ensure transparency and accountability.

- Innovation in Sustainable Finance: The demand for sustainable investment solutions is driving innovation in the financial sector, leading to the development of new products and services.

- Increased Collaboration: Collaboration between investors, companies, and policymakers is crucial to address the challenges and seize the opportunities presented by sustainable investing.

Conclusion: A Sustainable Future for Finance

The rise of sustainable investing is a powerful force reshaping global capital markets. It’s not just a passing trend; it’s a fundamental shift in investor behavior driven by a growing awareness of environmental and social issues. This trend is creating a new landscape for companies, demanding transparency, accountability, and a focus on long-term value creation.

While challenges remain, the future of finance is undeniably green. Sustainable investing is paving the way for a more responsible and equitable financial system, one that aligns with the values and aspirations of a growing global community. As investors continue to demand more sustainable investments, the financial world will continue to evolve, reflecting a commitment to building a better future for all.

We thank you for taking the time to read this article. See you in our next article!

Apoteksangiran.my.id News Bisnis Technology Tutorial

Apoteksangiran.my.id News Bisnis Technology Tutorial