With enthusiasm, let’s navigate through the intriguing topic related to A Green Tide: Sustainable Investing Surges, Reshaping Global Capital Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

A Green Tide: Sustainable Investing Surges, Reshaping Global Capital Markets

A Green Tide: Sustainable Investing Surges, Reshaping Global Capital Markets

The world is changing, and investors are taking notice. The once niche concept of sustainable investing has exploded into the mainstream, attracting billions of dollars and reshaping the global capital landscape. This surge in interest is not just a passing fad; it’s a fundamental shift in how investors approach their portfolios, driven by a confluence of factors, including environmental concerns, ethical considerations, and the growing awareness of the financial benefits of sustainable investments.

A Growing Green Portfolio:

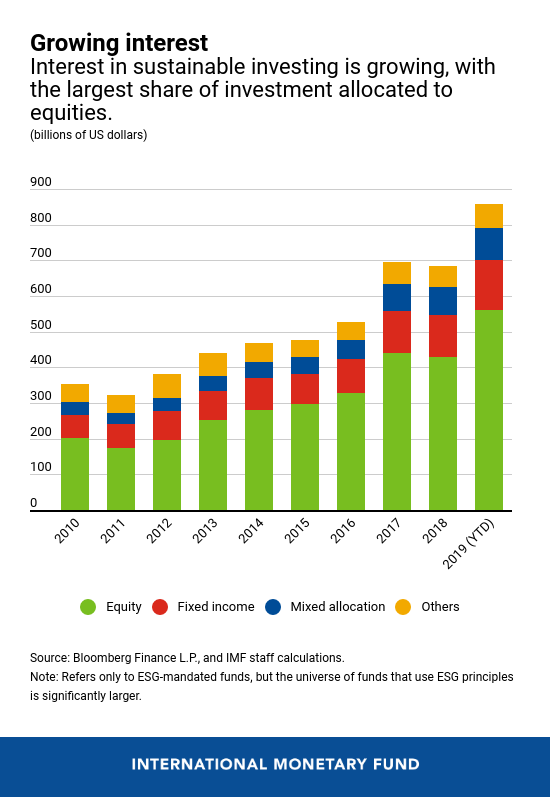

The evidence is undeniable: Sustainable investments are experiencing explosive growth. According to the Global Sustainable Investment Alliance (GSIA), global sustainable assets under management reached a staggering $35.3 trillion in 2020, representing a 16% year-on-year increase. This figure is expected to continue its upward trajectory, with analysts predicting that sustainable investments will become the dominant investment strategy in the coming decades.

This surge is evident across asset classes. Sustainable equity funds, which focus on companies with strong environmental, social, and governance (ESG) practices, have seen significant inflows, with assets under management exceeding $1.7 trillion in 2020. The bond market is also experiencing a green revolution, with the issuance of green bonds, which are specifically designed to finance environmentally friendly projects, reaching an all-time high in 2021.

Factors Driving the Sustainable Investing Boom:

Several key factors are driving this dramatic shift in investor behavior:

- Growing Environmental Awareness: The increasing awareness of climate change and its devastating consequences has spurred investors to seek out companies and projects that are actively working to reduce their environmental impact. This has led to a surge in demand for sustainable investments, particularly in renewable energy, green technology, and sustainable agriculture.

- Ethical Considerations: Investors are increasingly looking beyond financial returns and seeking investments that align with their personal values. Sustainable investing provides a way for investors to support companies that prioritize ethical practices, social responsibility, and human rights.

- Financial Performance: Contrary to the perception that sustainable investing comes at the cost of returns, studies have shown that sustainable companies often outperform their non-sustainable counterparts in the long run. This is due to their focus on long-term value creation, innovation, and responsible management practices.

- Regulatory Pressure: Governments around the world are increasingly implementing regulations to promote sustainable investing and reduce the environmental footprint of financial institutions. These regulations are creating a more favorable environment for sustainable investments, driving further growth in the sector.

- Technological Advancements: The rapid development of technologies like artificial intelligence and blockchain is enabling investors to access more data and insights about the sustainability performance of companies, facilitating informed investment decisions.

The Impact on Companies and Financial Markets:

The growing popularity of sustainable investing is having a profound impact on companies and financial markets:

- Increased Pressure on Companies: Companies are facing increasing pressure from investors to improve their ESG performance. This is driving companies to adopt more sustainable practices, reduce their carbon emissions, and improve their social and governance standards.

- Shift in Capital Allocation: As investors prioritize sustainable investments, capital is being increasingly allocated to companies and projects that align with ESG principles. This is creating new opportunities for sustainable businesses and driving innovation in sectors like renewable energy, clean transportation, and sustainable agriculture.

- Reshaping Financial Markets: The growth of sustainable investing is transforming the financial markets. New products and services are being developed to meet the increasing demand for sustainable investments, and financial institutions are adapting their strategies to incorporate ESG factors into their investment decisions.

- Increased Transparency and Disclosure: The demand for transparency and disclosure regarding ESG performance is increasing. Companies are being held accountable for their actions, and investors are increasingly scrutinizing their sustainability credentials.

The Future of Sustainable Investing:

The future of sustainable investing is bright. As the world continues to grapple with environmental challenges and social inequalities, the demand for investments that align with these issues is only going to grow.

The increasing availability of data, the development of innovative financial products, and the growing awareness of the financial benefits of sustainable investing will all contribute to the further growth of this sector.

Conclusion:

The surge in sustainable investing is not just a trend; it’s a fundamental shift in how investors approach their portfolios. Driven by environmental concerns, ethical considerations, and the growing awareness of the financial benefits of sustainable investments, this trend is reshaping global capital markets and driving positive change in the world. As investors continue to prioritize sustainability, the future of the global economy and the planet looks increasingly green.

Related Articles: A Green Tide: Sustainable Investing Surges, Reshaping Global Capital Markets

Thus, we hope this article has provided valuable insights into A Green Tide: Sustainable Investing Surges, Reshaping Global Capital Markets. We hope you find this article informative and beneficial. See you in our next article!

Apoteksangiran.my.id News Bisnis Technology Tutorial

Apoteksangiran.my.id News Bisnis Technology Tutorial