With enthusiasm, let’s navigate through the intriguing topic related to Investing for a Greener Future: A Beginner’s Guide to Sustainable Finance. Let’s weave interesting information and offer fresh perspectives to the readers.

Investing for a Greener Future: A Beginner’s Guide to Sustainable Finance

Investing for a Greener Future: A Beginner’s Guide to Sustainable Finance

The world is changing. Climate change, social inequality, and environmental degradation are no longer distant threats; they are realities impacting our daily lives. This shift in awareness has also rippled through the financial world, leading to a surge in interest in sustainable investing. More and more people are seeking investment opportunities that align with their values and contribute to a better future.

This article will act as your guide to navigating the exciting world of sustainable investing, providing a beginner-friendly overview of the key concepts, trends, and resources available. We’ll explore the factors driving this surge in sustainable investments, analyze its impact on companies and financial markets, and delve into the best books for beginners who want to learn more.

The Rise of Sustainable Investing: A Global Phenomenon

Sustainable investing, also known as responsible investing or impact investing, is a growing trend that prioritizes environmental, social, and governance (ESG) factors alongside financial returns. This approach goes beyond simply avoiding "bad" companies; it actively seeks out investments that promote positive social and environmental change.

The evidence of this trend is undeniable:

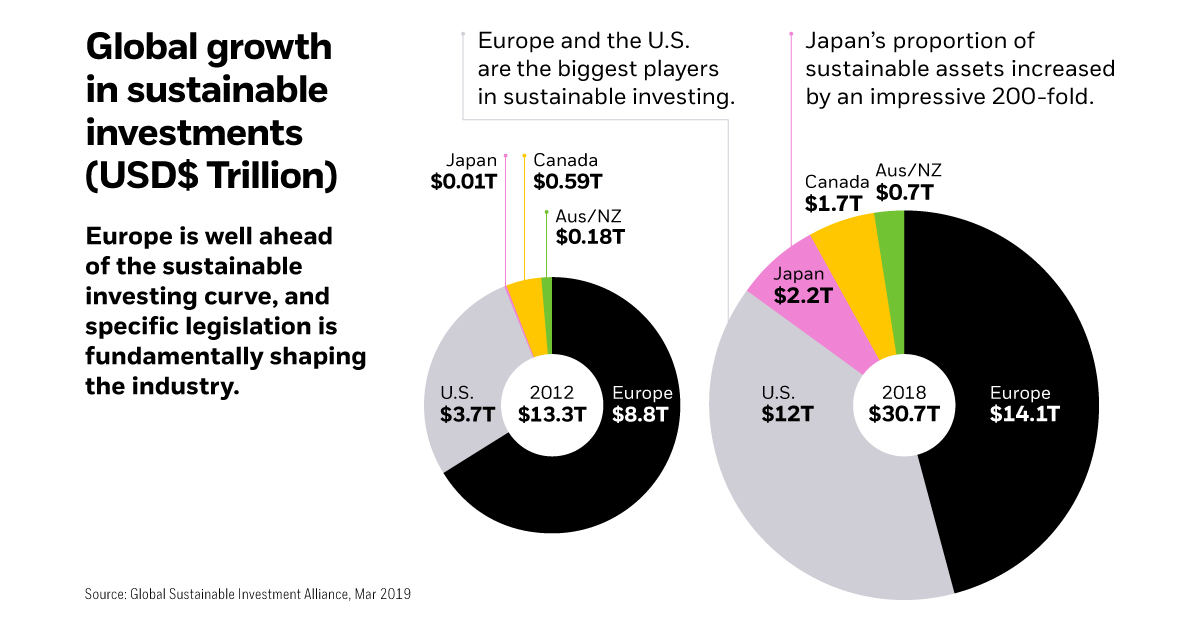

- Asset Growth: Global assets under management in sustainable funds have skyrocketed. According to Morningstar, sustainable funds globally reached $3.89 trillion in assets by the end of 2021, a 33% increase from the previous year. This growth is expected to continue, with estimates predicting the global sustainable investment market to reach $50 trillion by 2025.

- Investor Demand: The demand for sustainable investments is driven by a growing awareness of the interconnectedness of social, environmental, and economic issues. Millennials and Gen Z, in particular, are increasingly prioritizing ethical investing, aligning their portfolios with their values.

- Regulatory Support: Governments and regulatory bodies are increasingly recognizing the importance of sustainable finance. The European Union has implemented the Sustainable Finance Disclosure Regulation (SFDR), requiring financial institutions to disclose their ESG practices. Similar regulations are emerging globally, creating a more transparent and standardized framework for sustainable investing.

Factors Driving the Sustainable Investing Boom:

Several factors have contributed to the rapid rise of sustainable investing:

- Climate Change Awareness: The increasing urgency of climate change has spurred investors to seek out companies committed to reducing their environmental impact. Investments in renewable energy, energy efficiency, and sustainable agriculture are becoming increasingly popular.

- Social Impact: Investors are increasingly aware of the social impact of their investments. This includes supporting companies that promote diversity and inclusion, fair labor practices, and responsible supply chains.

- Long-Term Value: Sustainable investing is not just about doing good; it’s also about doing well. Studies have shown that companies with strong ESG practices tend to outperform their peers in the long run. This is because they are better equipped to manage risks and capitalize on opportunities related to climate change, resource scarcity, and social inequality.

- Technological Advancements: Advancements in data analytics and technology have made it easier for investors to track and measure the ESG performance of companies. This has increased transparency and accountability, making it easier to identify investments aligned with ethical values.

Impact on Companies and Financial Markets:

The rise of sustainable investing is having a profound impact on companies and financial markets:

- ESG Integration: Companies are increasingly integrating ESG factors into their business strategies. They are reporting on their environmental and social performance, setting ambitious sustainability goals, and engaging with stakeholders on ESG issues.

- Increased Scrutiny: Companies are facing increased scrutiny from investors, regulators, and the public on their ESG performance. This is leading to greater transparency and accountability, and companies that fail to meet ESG standards risk facing reputational damage and investor backlash.

- Investment Opportunities: The growing demand for sustainable investments is creating new investment opportunities in sectors like renewable energy, clean technology, and sustainable agriculture. This is leading to innovation and job creation in these sectors.

- Market Evolution: The rise of sustainable investing is transforming the financial landscape. New investment products, such as ESG-focused ETFs and mutual funds, are emerging, and traditional financial institutions are adapting their offerings to meet the growing demand for sustainable investments.

Navigating the Sustainable Investing Landscape: Books for Beginners

For beginners interested in exploring sustainable investing, several excellent resources are available:

1. "The Sustainable Investor: A Guide to Responsible Investing" by Andrew Beecroft: This comprehensive guide provides a practical overview of sustainable investing, covering key concepts, strategies, and resources. It also includes case studies and real-world examples to illustrate the potential of sustainable investing.

Related Articles: Investing for a Greener Future: A Beginner’s Guide to Sustainable Finance

Thus, we hope this article has provided valuable insights into Investing for a Greener Future: A Beginner’s Guide to Sustainable Finance.

2. "Investing in a Sustainable Future: A Guide to Impact Investing" by David Blood and Antony Bugg-Levine: This book explores the emerging field of impact investing, which aims to generate both financial returns and positive social and environmental impact. It provides insights into the different types of impact investments, their potential benefits, and the challenges involved.

3. "ESG Investing: A Guide for Investors" by Julie Fox Gorte and Michael J. Bruhn: This book offers a clear and concise introduction to ESG investing, covering the key principles, factors to consider, and strategies for investing in companies with strong ESG practices. It also includes practical tips for evaluating ESG performance and identifying investment opportunities.

4. "The Responsible Investor: How to Make a Difference with Your Money" by Simon Zadek: This book explores the ethical dimensions of investing and provides a framework for making responsible investment decisions. It covers topics such as corporate social responsibility, ethical banking, and microfinance.

5. "Investing in the Future: A Guide to Sustainable and Impact Investing" by the Global Impact Investing Network (GIIN): This book provides a comprehensive overview of impact investing, covering its history, principles, and potential for driving positive social and environmental change. It also includes case studies and practical guidance for investors.

Conclusion: A Greener Future Through Sustainable Investing

The rise of sustainable investing is a testament to the growing awareness of the interconnectedness of social, environmental, and economic issues. Investors are increasingly recognizing that their financial decisions can have a positive impact on the world. By investing in companies and projects that promote sustainability, investors can contribute to a greener, more equitable, and prosperous future.

This journey into sustainable investing is just beginning. As the trend continues to gain momentum, we can expect to see further innovation in investment products, increased transparency and accountability from companies, and greater regulatory support for sustainable finance.

Investing in a sustainable future is not just a trend; it’s a necessity. By educating ourselves, making informed decisions, and demanding accountability from companies and financial institutions, we can collectively drive positive change and build a better future for generations to come.

We appreciate your attention to our article. See you in our next article!

Apoteksangiran.my.id News Bisnis Technology Tutorial

Apoteksangiran.my.id News Bisnis Technology Tutorial