With great pleasure, we will explore the intriguing topic related to Sustainable Investing: A Green Wave Sweeping Global Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

Sustainable Investing: A Green Wave Sweeping Global Markets

Sustainable Investing: A Green Wave Sweeping Global Markets

The world is changing. Climate change is no longer a distant threat, but a present reality. Consumers are demanding more sustainable products and services, and investors are increasingly aligning their portfolios with their values. This shift towards sustainable investing is not just a trend, it’s a revolution, reshaping the landscape of global capital markets.

A Surge in Sustainable Assets:

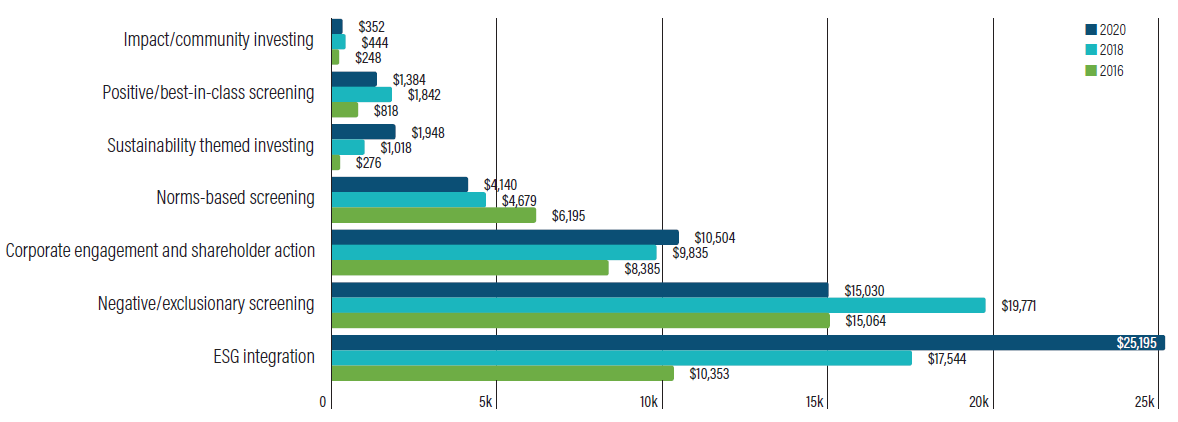

The numbers speak volumes. Global sustainable investment assets have skyrocketed in recent years, reaching a staggering $35.3 trillion in 2020, according to the Global Sustainable Investment Alliance (GSIA). This represents a massive 34% increase from 2018, demonstrating the undeniable momentum of this movement.

Driving Forces Behind the Green Revolution:

This surge in sustainable investing is driven by a confluence of factors:

1. Growing Environmental Concerns:

Climate change is no longer a fringe issue. Extreme weather events, rising sea levels, and biodiversity loss are becoming increasingly evident, fueling public demand for action. Investors are recognizing that addressing these challenges is not just a moral imperative, but also a financial one.

2. Societal Expectations:

Consumers are demanding more ethical and sustainable products and services. Companies are facing increasing pressure to demonstrate their commitment to social and environmental responsibility. Investors are aligning their portfolios with these values, seeking out companies that are making a positive impact on the world.

3. Regulatory Developments:

Governments around the world are implementing regulations to promote sustainable investing and disclose environmental, social, and governance (ESG) data. This includes mandatory reporting requirements, tax incentives for sustainable investments, and policies that restrict investments in certain industries like fossil fuels.

4. Technological Advancements:

Technological innovations are making it easier for investors to access sustainable investment options. Online platforms and robo-advisors are offering tailored portfolios that align with specific ESG criteria. This increased accessibility is further driving the adoption of sustainable investing.

Impact on Companies and Financial Markets:

The influx of capital into sustainable funds is having a profound impact on companies and financial markets:

1. Pressure on Companies to Improve ESG Performance:

Companies are facing increasing pressure from investors to improve their ESG performance. This includes reducing their carbon footprint, promoting diversity and inclusion, and ensuring ethical business practices. Companies that fail to meet these expectations risk losing access to capital and facing reputational damage.

2. Emergence of New Investment Opportunities:

The growth of sustainable investing is creating new investment opportunities in sectors like renewable energy, green technology, and sustainable agriculture. These sectors are attracting significant capital inflows, driving innovation and economic growth.

3. Redefining Risk and Return:

Sustainable investing is challenging the traditional view of risk and return. Investors are recognizing that companies with strong ESG performance can be less risky and more profitable in the long term. This is leading to a re-evaluation of investment strategies, with a focus on sustainability as a key factor in decision-making.

4. Shifting Capital Flows:

The growing demand for sustainable investments is leading to a shift in capital flows away from traditional sectors like fossil fuels and towards industries that are contributing to a more sustainable future. This shift is accelerating the transition to a low-carbon economy and driving innovation in clean technologies.

Vanguard’s Role in Sustainable Investing:

Vanguard, a leading investment management firm, has recognized the growing importance of sustainable investing. The company offers a range of sustainable investment funds, including:

- Vanguard ESG US Stock ETF (ESGV): This ETF tracks the performance of US stocks with strong ESG scores.

- Vanguard Global Sustainable Equity Index Fund (VGSLX): This fund invests in a diversified portfolio of global stocks that meet specific ESG criteria.

- Vanguard FTSE Social Index Fund (VFTAX): This fund invests in companies that meet ethical standards, including those involved in social justice, environmental protection, and responsible governance.

Related Articles: Sustainable Investing: A Green Wave Sweeping Global Markets

Thus, we hope this article has provided valuable insights into Sustainable Investing: A Green Wave Sweeping Global Markets.

By offering these funds, Vanguard is making it easier for investors to align their portfolios with their values and participate in the growing sustainable investment market.

Challenges and Opportunities:

While the growth of sustainable investing is encouraging, there are still challenges to overcome:

1. Lack of Standardization:

There is no single universally accepted definition of sustainability or ESG criteria. This can lead to confusion and inconsistency in the way companies are assessed and ranked.

2. Data Transparency and Accuracy:

The quality and availability of ESG data can vary significantly. This can make it difficult for investors to accurately assess the sustainability performance of companies.

3. Greenwashing:

Some companies may engage in "greenwashing," claiming to be sustainable without actually implementing meaningful changes. This can mislead investors and undermine the credibility of the sustainable investing movement.

4. Regulatory Uncertainty:

The regulatory landscape for sustainable investing is still evolving. This can create uncertainty for investors and make it difficult to navigate the complexities of the market.

Despite these challenges, the opportunities for sustainable investing are immense:

1. Growing Investor Demand:

The demand for sustainable investments is only going to increase in the future as investors become more aware of the environmental and social risks and opportunities associated with their investments.

2. Technological Advancements:

Technological advancements are making it easier to access and analyze ESG data, enabling investors to make more informed decisions.

3. Policy Support:

Governments around the world are increasingly supporting sustainable investing through regulations, incentives, and policies.

Conclusion:

The green wave of sustainable investing is sweeping across global capital markets, driven by growing environmental concerns, societal expectations, regulatory developments, and technological advancements. This trend is having a profound impact on companies and financial markets, leading to a shift in capital flows towards industries that are contributing to a more sustainable future.

While challenges remain, the opportunities for sustainable investing are vast. Investors who embrace this trend are not only aligning their portfolios with their values, but also positioning themselves for long-term success in a world that is increasingly focused on sustainability.

We thank you for taking the time to read this article. See you in our next article!

Apoteksangiran.my.id News Bisnis Technology Tutorial

Apoteksangiran.my.id News Bisnis Technology Tutorial