In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Green Rush: Sustainable Investing Takes Center Stage in Global Capital Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

The Green Rush: Sustainable Investing Takes Center Stage in Global Capital Markets

The Green Rush: Sustainable Investing Takes Center Stage in Global Capital Markets

The world is waking up to the urgency of climate change and environmental degradation. This awareness is not just impacting individual choices, but also driving a seismic shift in the financial landscape. Investors, increasingly conscious of the long-term implications of their decisions, are flocking towards sustainable investments, ushering in a new era of "green finance." This trend is not just a passing fad; it’s a powerful force reshaping global capital markets, impacting companies, financial institutions, and ultimately, the future of our planet.

A Surge in Sustainable Funds:

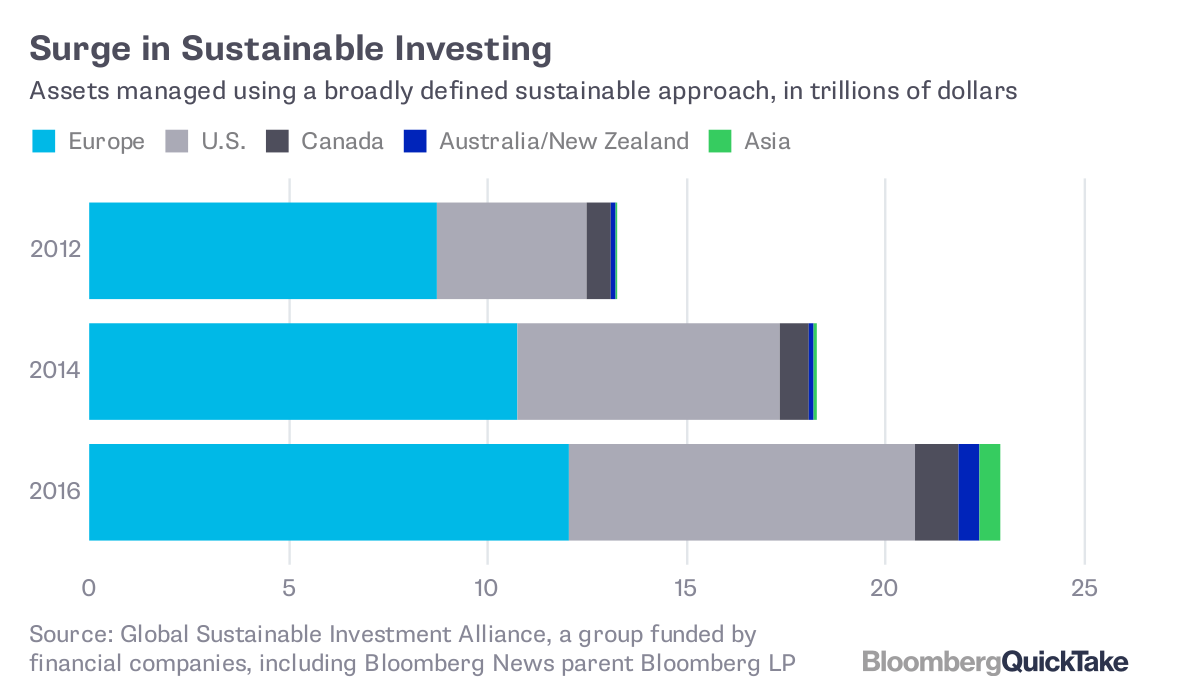

The numbers tell a compelling story. Assets under management (AUM) in sustainable funds are skyrocketing. In 2021 alone, global sustainable investment assets reached a staggering $35.3 trillion, a 15% increase from the previous year, according to the Global Sustainable Investment Alliance (GSIA). This surge is driven by a confluence of factors, including:

- Investor Demand: Millennials and Gen Z, known for their strong environmental and social values, are increasingly demanding investment options that align with their ethical convictions. They see investing in sustainable companies as a way to make a positive impact on the world while earning returns.

- Regulatory Pressure: Governments and regulatory bodies worldwide are enacting policies and regulations that incentivize sustainable investing, such as mandatory ESG (Environmental, Social, and Governance) reporting for listed companies.

- Growing Awareness: The media is increasingly covering the climate crisis and the environmental and social impact of corporations. This heightened awareness is pushing investors to consider the long-term risks associated with unsustainable business practices.

- Financial Performance: Studies have shown that companies with strong ESG performance tend to outperform their peers in the long run. This data is convincing investors that sustainable investing is not just about doing good, but also about doing well financially.

The Impact on Companies:

This growing appetite for sustainable investments is creating significant pressure on companies to adopt sustainable practices and improve their ESG performance. Those that fail to do so risk facing investor backlash, reputational damage, and even regulatory sanctions. This pressure is driving companies to:

- Reduce their carbon footprint: Companies are investing in renewable energy, reducing their emissions, and implementing energy efficiency measures to lower their environmental impact.

- Improve their social impact: They are focusing on fair labor practices, diversity and inclusion, and community engagement to enhance their social responsibility.

- Strengthen their governance: Companies are adopting transparent and ethical governance practices, including independent board oversight and robust risk management systems.

The shift towards sustainable investing is also leading to a rise in ESG-focused investment products, such as thematic ETFs, impact bonds, and green bonds. These products allow investors to target specific sectors or areas of sustainable investment, such as renewable energy, clean water, or sustainable agriculture.

Transforming Financial Markets:

The rise of sustainable investing is fundamentally transforming financial markets. It’s driving a shift towards a more long-term, responsible, and transparent approach to investing. This shift is reflected in:

- Increased transparency: Sustainable investing demands greater transparency from companies about their environmental and social impact. This is leading to the development of standardized ESG reporting frameworks and the emergence of independent ESG rating agencies.

- Integration of ESG factors: ESG factors are becoming increasingly integrated into investment analysis and decision-making processes. This means that investors are considering not just financial performance, but also environmental, social, and governance factors when making investment decisions.

- Emergence of new asset classes: The growing demand for sustainable investments is leading to the emergence of new asset classes, such as green bonds and impact investments, which focus on specific environmental or social goals.

Challenges and Opportunities:

Despite the growing momentum behind sustainable investing, there are still significant challenges to overcome. These include:

- Greenwashing: Some companies are engaging in "greenwashing" by making misleading claims about their sustainability performance. This can erode investor trust and hinder the growth of the sustainable investment market.

- Data availability and quality: There is still a lack of standardized and reliable data on ESG performance, making it difficult for investors to accurately assess the sustainability of companies.

- Measuring impact: It can be challenging to measure the actual impact of sustainable investments. This makes it difficult to assess the effectiveness of investment strategies and to track progress towards achieving sustainable development goals.

Related Articles: The Green Rush: Sustainable Investing Takes Center Stage in Global Capital Markets

Thus, we hope this article has provided valuable insights into The Green Rush: Sustainable Investing Takes Center Stage in Global Capital Markets.

However, these challenges also present opportunities for innovation. The rise of sustainable investing is driving the development of:

- New technologies: Artificial intelligence (AI) and machine learning are being used to develop tools that can analyze ESG data, identify greenwashing, and measure the impact of sustainable investments.

- Innovative investment products: Financial institutions are developing new investment products that cater to the growing demand for sustainable investments, such as impact bonds and green bonds.

- Increased collaboration: Governments, financial institutions, and investors are working together to develop standards, promote transparency, and accelerate the transition to a sustainable financial system.

The Future of Sustainable Investing:

The trend towards sustainable investing is likely to continue to accelerate in the coming years. As awareness of the climate crisis grows, and investors increasingly demand investment options that align with their values, the pressure on companies to adopt sustainable practices will only intensify. This will drive further innovation in the financial sector, leading to the development of new investment products, technologies, and frameworks that support the transition to a more sustainable and equitable future.

In conclusion, the rise of sustainable investing is a powerful force reshaping global capital markets. It is driving a shift towards a more responsible, transparent, and long-term approach to investing, with significant implications for companies, financial institutions, and the future of our planet. The challenges are real, but the opportunities for innovation and positive change are even greater. As investors continue to prioritize sustainability, we can expect to see a continued surge in sustainable investments, leading to a more sustainable and equitable future for all.

We thank you for taking the time to read this article. See you in our next article!

Apoteksangiran.my.id News Bisnis Technology Tutorial

Apoteksangiran.my.id News Bisnis Technology Tutorial